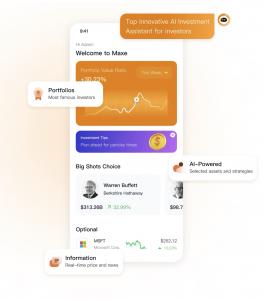

maxe ai assistant functions

MAXE: The Revolutionary AI Financial Management App

NEW YORK, NEW YORK, U.S., August 2, 2024 /EINPresswire.com/ — On July 31, 2024, the Federal Reserve announced its interest rate decision for July. The Federal Open Market Committee (FOMC) unanimously voted to maintain the federal funds rate range at 5.25%-5.50%.In response to this announcement, the three major U.S. stock market indices experienced a sharp rise during the trading session. Additionally, U.S. Treasury yields and the U.S. dollar index both weakened under the pressure of the Fed’s decision.

In the current market environment, many ordinary investors wonder how to adjust their portfolios. While the outlook is uncertain, there are proactive steps average investors can take to offset the impact and potentially gain.

Here are two proven investment moves to consider:

1. The key difference between ordinary investors and industry leaders lies in their market understanding and ability to access timely information. Leaders deeply comprehend trends and can swiftly adjust strategies to boost returns. If ordinary investors can reference the portfolios of successful individuals, it can help them make better-informed decisions.

2. Access the latest financial market information, presented visually. This data can provide a comprehensive view of the landscape. Simultaneously, get professional investment suggestions. These suggestions can help you make informed, accurate investment choices. Combining timely, visual data with professional investment suggestions can enhance your decision-making, especially during market uncertainty.

In response to the points raised above, a leading investment tracking app, MAXE, offers a solution to help investors make better investment decisions

MAXE’s flagship feature allows users to directly view and monitor the investment portfolios of industry-leading experts across multiple sectors. This functionality is particularly valuable given the current volatility in the financial markets. This visibility into the real-time portfolio compositions and trading patterns of the market’s foremost investors serves as a valuable learning resource. By studying the asset allocations and trading activities of these elite investors, MAXE users can make better investment decisions.

At the same time, MAXE’s advanced artificial intelligence engine generates personalized investment recommendations tailored to each user’s unique risk profile and portfolio performance. This feature empowers users to receive timely, data-driven guidance calibrated to the evolving market environment. By factoring in users’ individual investment objectives and risk tolerance, the AI-powered recommendation system enables more targeted, actionable insights to inform their decision-making.

Finally, MAXE provides diversified and visualized financial market data, which allows users to analyze their asset portfolio data more clearly through multiple dimensions.

MAXE serves users around the globe. As of now, the cumulative number of users who have downloaded the MAXE app has exceeded 200,000. This milestone indicates that an ever-growing number of individuals recognize the value of MAXE and are utilizing the APP to optimize their investment and financial management strategies.

Now, MAXE is available on Google Play and App Store . Say goodbye to traditional financial management methods and embrace the future of finance with MAXE. For more information, visit our website at www.maxeai.com and follow us on social media for updates and tips on financial management.

Ying Wang

MAXE AI

6991 2300

email us here

![]()

Article originally published on www.einpresswire.com as Two Proven Investment Moves for Average Investors to Boost Returns After the Fed’s July Rate Decision

The post Two Proven Investment Moves for Average Investors to Boost Returns After the Fed’s July Rate Decision first appeared on Social Gov.

originally published at Global News - Social Gov

,

,